Issues insurance is a specialized brand of insurance policies that give publicity against possessions destroy for the reason that certain absolute incidents and you may specific hazards. It’s made to include home owners about financial drop out ones unforeseen disasters. Basically, it will not tend to be flooding exposure, hence must be bought alone, sometimes regarding the federal government or personal ton insurance companies.

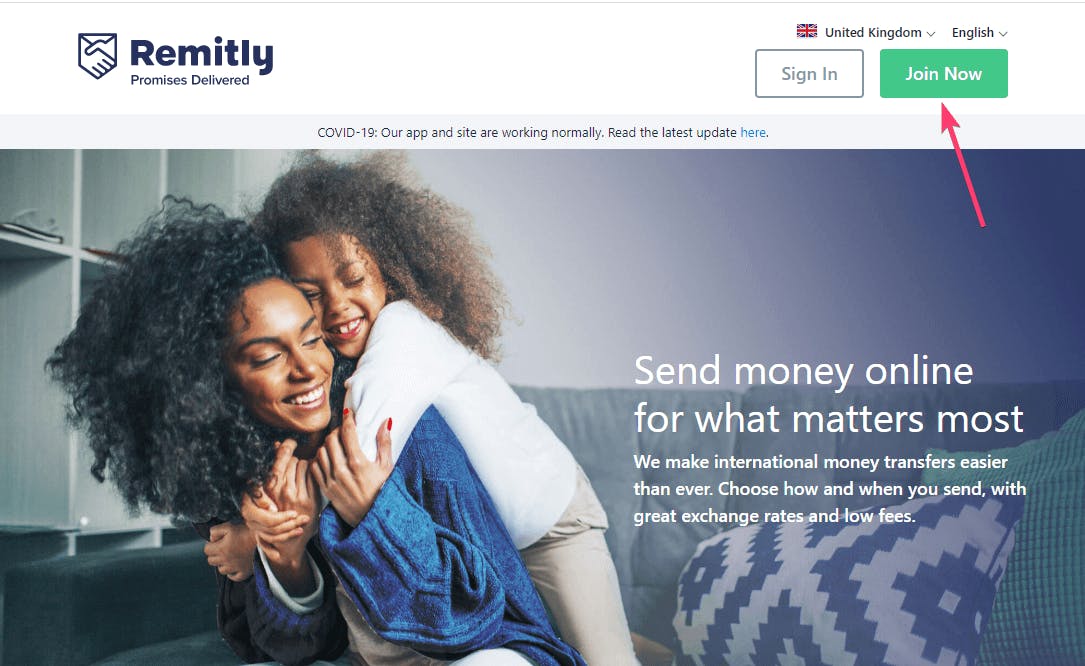

Navigating the newest state-of-the-art world of home relates to more than just complimentary customers with the fantasy belongings or helping manufacturers inside product sales its characteristics. It border a comprehensive comprehension of new myriad areas of homeownership, for instance the vital part out of insurance coverage.

Continue reading understand just what chances insurance is, how it compares to homeowners insurance, their significance to own home buyers, and you may and this homeowners are interested, in order to most useful book your clients.

Hazard insurance rates may be a crucial part regarding the homeownership excursion to have home buyers and you may real estate professionals. Knowing its characteristics, let’s consider several important issues.

Threat insurance come with varying title lengths, and homebuyers should become aware of its choices. Certain regulations render coverage having quicker words, although some offer shelter for much more long periods. The option of term duration should fall into line toward homeowner’s requires and tastes.

Chances insurance policy is not a single-size-fits-all the services. Certain geographical countries be a little more subject to specific problems. For-instance, areas prone to flood or earthquakes may necessitate possibility insurance coverage so you can decrease brand new associated risks. Just like the a real estate professional, knowing the book dangers of areas you serve are going to be indispensable inside the at the rear of customers.

Sometimes, danger insurance policies tends to be needed seriously to secure home financing. Lenders often require one to borrowers enjoys chances insurance in advance of giving an effective mortgage.

Risk Insurance policies compared to. Homeowners insurance

Possibility insurance is specifically made to provide monetary safeguards to homeowners in case of unexpected catastrophes. The fresh range regarding exposure available with chances insurance policies can differ of one to coverage to another. Nonetheless, it generally includes cover against risks such fire, wind, hail, lightning, and other disasters.

Although not, its crucial to understand what issues insurance coverage doesn’t protection. In the place of home insurance, which is a far more wider-oriented style of publicity, hazard insurance rates will not extend the safeguards so you can private residential property, responsibility says, thieves, otherwise vandalism. A comprehensive home insurance rules normally addresses these types of issues.

The possibility ranging from chances insurance and you will home insurance utilizes personal needs and you may facts. If the property owners require cover beyond possessions wreck and you can look for exposure to have individual homes and you can responsibility, home insurance is the alot more comprehensive alternative.

Finest 5 Things about Risk Insurance rates

Services in a few section have an abnormally high risk chance due to individuals issues, along with flood zones, quake zones, and high-crime section. Below are a few key reason why property otherwise customer can get end up being a good fit to have risk insurance:

- Geographical Susceptability: Characteristics into the section prone to natural disasters, instance https://cashadvanceamerica.net/2500-dollar-payday-loan/ hurricanes, earthquakes, otherwise floods, may require possibility insurance to decrease financial risks.

- Comfort: Property owners whom seek support facing unexpected incidents will benefit out-of chances insurance rates.

- Property value Preservation: Danger insurance rates could help include and you will manage the worth of an effective property by level repair otherwise replacement can cost you if there is damage.

- Tailored Visibility: It could be you can easily to help you tailor risk insurance rates to fulfill the demands out-of home owners, guaranteeing they have enough safeguards.

Not all homeowner need chances insurance coverage, as its criteria relies on some situations. Real estate professionals play a vital role in helping website subscribers determine in the event the danger insurance policy is the right choice.

Furthermore, real estate professionals is instruct their clients concerning the advantages of risk insurance rates, explaining which may provide financial protection in a situation away from need and safeguard their property financial support. By effectively conveying this short article, representatives can be empower their clients and then make told conclusion regarding their insurance.

Is actually Hazard Insurance rates Required by Lenders?

Occasionally, mortgage brokers wanted home owners getting insurance rates as the a disorder having protecting a home loan. So it specifications usually comes with each other chances publicity and responsibility coverage and you may is usually integrated into a home owners insurance policy.

Lenders demand it criteria to guard their monetary appeal regarding knowledge out of property damage. Hazard insurance means the house or property remains adequately safe, decreasing the risk of a substantial monetary loss for the resident plus the bank. It is important the real deal property gurus to speak which requirements in order to their clients, since it is a non-flexible aspect of the homebuying processes.

Do The client You want Possibilities Insurance policies?

Threat insurance rates takes on a crucial character for the defending residents facing natural calamities and unexpected potential risks. Even though it provides valuable coverage to own possessions ruin as a result of particular danger, it is crucial to admit its limitations and you may comprehend the variations anywhere between chances insurance rates and you will homeowners insurance.

Real estate agents and Realtors, members of the National Organization out of Realtors, is book their clients on necessity of danger insurance policies mainly based on their specific facts, emphasizing their pros inside the large-chance elements so when a lender requisite. In so doing, agencies could possibly get empower their customers and come up with well-advised conclusion about their insurance, guaranteeing their houses are protected from life’s unforeseen demands.

Popularity: 1% [?]