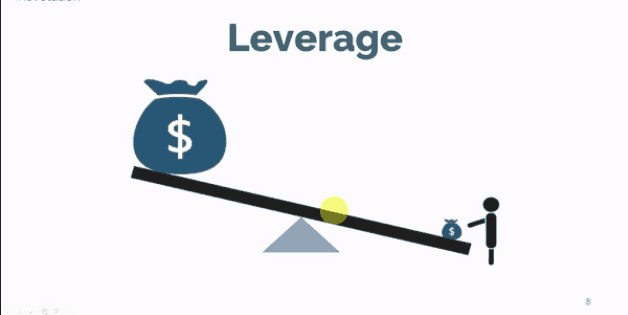

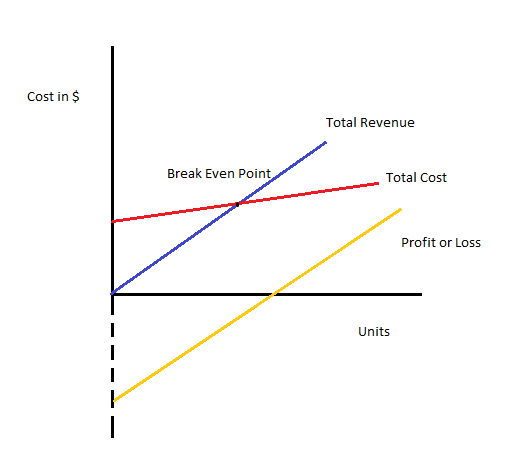

The break-even point is calculated by dividing your fixed costs by the difference between the sales price per unit and the variable cost per unit. Lastly, it’s valuable to consider contribution margin analysis in conjunction with break-even analysis. This involves calculating the contribution margin per product (selling price minus variable cost) to determine how much each unit contributes to covering fixed costs. By knowing the minimum number of units a company needs to sell to cover costs, businesses can set prices that ensure profitability while remaining competitive. This analysis also promotes cost control by revealing how fixed and variable costs impact profitability.

What Are Some Limitations of Break-Even Analysis?

- Input your data and get instant results for informed financial decision-making.

- Variable costs are calculated on a per-unit basis, so if you produce or sell more units, the variable cost will increase.

- A “solar payback period” is a fancy way of talking about how long it takes for the money you spent to be outweighed by the money you’re saving (or earning) on your electricity bill.

- If you sell more than your break-even point, you’re making a profit.

- Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized.

- Whether you’re trying to promote your brand-new product, stay ahead of your competitors, or cut down on your expenses, you need to have a strategy in place.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or revolving credit facility qualifies for an exemption or exclusion from registration requirements. Yes, you can use this calculator for any type of business, including manufacturing, retail, and services. With the break even result you can start to analyze the micro components that create the overall cost.

When determining a break-even point based on sales dollars:

Some common examples of fixed costs include rent, insurance premiums, and salaries. You can see that all of these costs do not change even if you increase production or make more sales in a particular month. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas price and variable costs are stated as per unit costs—the price for each product unit sold. Calculating the break-even point is crucial in managing your company finances.

Is your sales price right?

This article was written by our expert who is surveying the industry and constantly updating business plan for a mobile app. Please review their policies, terms and notices for more information. MIDFLORIDA Credit Union does not operate or monitor their site, and is not responsible for the information, products or services offered. This means Sam’s team needs to sell $2727 worth of Sam’s Silly Soda in that month, to break even. These software packages automatically pull in relevant financial data, such as costs and revenue, to calculate the BEP, eliminating the need for manual data entry. Excel’s versatility and ability to handle complex calculations make it a popular choice for businesses of all sizes, and templates for break-even analysis are widely available.

Break-Even Analysis Chart

Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution.

After entering the end result being solved for (i.e., the net profit of zero), the tool determines the value of the variable (i.e., the number of units that must be sold) that makes the equation true. A “solar payback period” is a fancy way of talking about how long it takes for the money you spent to be outweighed by the money you’re saving (or earning) on your electricity bill. Sensitivity analysis involves changing key variables, such as costs and revenue, to see how they affect the break-even point. Fixed costs include expenses that do not change with the number of downloads, such as development, marketing, and server maintenance fees. Plug in the values from steps 1 to 3 into the formula and calculate the break-even point in units.

Enter some basic information below, and we’ll instantly provide a free estimate of your energy savings. Solar panels can save you a lot of money on electricity, and might even make you money if you can sell energy back to the grid. Balancing marketing spend with expected returns is crucial for financial success. Effective marketing can increase user acquisition, potentially reducing the break-even time frame.

For example, if the economy is in a recession, your sales might drop. If sales drop, then you may risk not selling enough to meet your breakeven point. In the example of XYZ Corporation, you might not sell the 50,000 units necessary to break even.

Having high fixed costs puts a lot of pressure on a business to make up those expenses with sales revenue. If you find yourself falling short of your break-even point month over month and feel like you can’t change your prices, lowering your fixed costs can be a solution. Break-even analysis helps businesses choose pricing strategies, and manage costs and operations.

Please go ahead and use the calculator, we hope it’s fairly straightforward. If you’d rather calculate it manually, below we have described how to calculate the break-even point, and even explained what is the break-even point formula. In contrast to fixed costs, variable costs increase (or decrease) based on the number of units sold. If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa). Your variable costs (or variable expenses) are the expenses that do change with your sales volume.

Popularity: unranked [?]