An enthusiastic Arkansas Outlying Development Mortgage try a mortgage right back by the Agency out-of Agriculture you to residents and you can home buyers within the Arkansas can take advantage of. It is a national-insured mortgage which is more commonly offered by individual loan providers and supported by the federal government. Whenever a personal bank offers this mortgage equipment its called a guaranteed loan whereas when your borrower goes right to the local USDA work environment it is called an effective USDA lead mortgage. The USDA or Outlying Invention even offers too many great benefits in order to Arkansas buyers.

The newest Arkansas rural advancement loan has many masters however there are not one more than the brand new 100% no cash off feature. The fresh new USDA financing is the simply financing getting low-veterans which provides this feature. Homeowners can acquire property no currency required for the brand new advance payment. While all of the loan models enjoys settlement costs brand new USDA outlying invention financing is of interest in this field as well. The mortgage tool allows the seller to invest doing 6% of sales speed towards the customers closing costs. Particularly, should your sales price is $125,000 the vendor will pay up to six% of your closing costs and pre-paids things that in this instance comes out are $seven,500. This is most days was ample to fund everything hence making it possible for the customer to seriously go into property with no currency out-of-pocket. Another great work for is the flexibility of one’s borrowing https://www.paydayloansconnecticut.com/lakes-west from the bank conditions. Borrowers only have to feel three years removed from bankruptcy and 36 months taken from foreclosures.

What are the Conditions To have An effective Arkansas Outlying Advancement Mortgage?

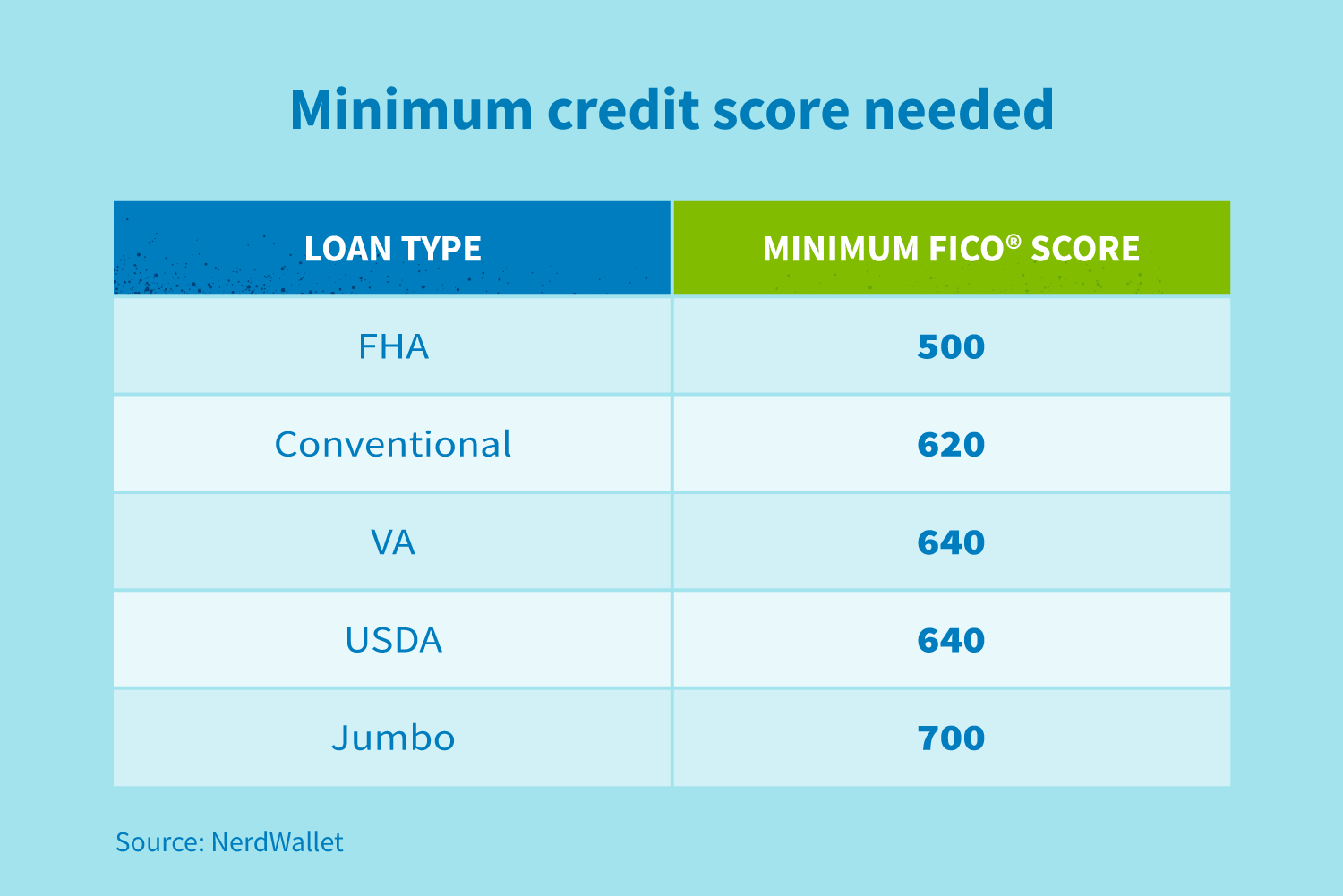

The requirements getting a rural creativity mortgage otherwise a great USDA financing are set forth by the bodies. The only variance which is often viewed anywhere between lenders is the credit score specifications. The reason behind this is your USDA commercially does not provides the very least rating need for brand new unmarried-friends housing program alternatively it is kept doing anyone lender to choose what rating they wish to use. Really lenders are about 640-660 for their score standards. Some go a tiny down such as for instance Number 1 Domestic Mortgage and this simply needs an effective 620 borrowing from the bank and there’s some you to possess highest conditions. The new USDA mortgage along with allows consumers which can enjoys a finite credit score otherwise borrowing from the bank depth to utilize what is actually called alternative tradelines. These are points that would not normally be discovered toward good credit report eg bills, cellular phone expense, and you can insurance policies money. The fresh new USDA outlying creativity loan lets loan providers to determine a last within these membership products to build credit.

Which are the Money Requirements Having An excellent USDA Arkansas Loan?

The latest Arkansas USDA loan has two standards associated with the money. The first is discover with all finance in fact it is new disgusting monthly earnings in the place of the month-to-month obligations. This is certainly a pretty simple algorithm. One which confuses a lot of people ‘s the household earnings criteria. This might be a feature that is unique merely to the fresh USDA single-home financing. The brand new USDA financing is made for reduced so you can average-income households from inside the rural section. The new keywords try domestic. The most house income enjoy was 115% of your own median on offered area. It varies from state to state and you will county to county. An example will be if for example the median family income is actually $78,000 x115%= $8,970 + $78,000= $86,970. The most challenging procedure getting consumers to understand using this type of guideline is the fact the household and not simply that is towards mortgage. Eg, in the event that discover about three working people inside the property however, just one of them is on the mortgage others money nonetheless needs to be regarded as household money.

Popularity: 1% [?]