Homeowners with dependent several years’ equity into their belongings could possibly take advantage of this valuable house because of the putting it be effective. Are you aware you could re-finance and make use of your own built-right up equity to settle consumer expense particularly handmade cards, non-mortgage loans, or other costs? It is a fact!

Debt consolidation refinancing is actually a famous option for specific home owners-which can be since it simplifies bill investing, can reduce the amount of money supposed towards the personal debt solution for every single week, and you may allows for even more monetary independence.

Property owners can get inquire, Are a house refinance to help you combine personal debt the best choice for myself? If you’re considering refinancing, the professionals was right here in order to see the ins and outs from a debt consolidation financing to make the choice that is right for you.

Reduce your Speed

Refinancing to help you a diminished interest can cause significant a lot of time-term coupons and relieve the monthly mortgage payments. By securing a much better rate, you can save currency across the lifetime of the loan, freeing have a peek at this web site right up financing to other economic needs or expenditures.

Pay off Debt

By experiencing the home’s guarantee, you could potentially pay-off a fantastic bills and savor just one, lower-focus monthly payment, simplifying your money and you can reducing full appeal will cost you.

All the way down Mortgage repayment

Lower your monthly homeloan payment that have a straightforward refinance. From the changing the loan terms or protecting a reduced interest rate, it can save you thousands of dollars per year, and then make the home loan less costly and you will reducing your financial weight.

What is actually a debt settlement Re-finance?

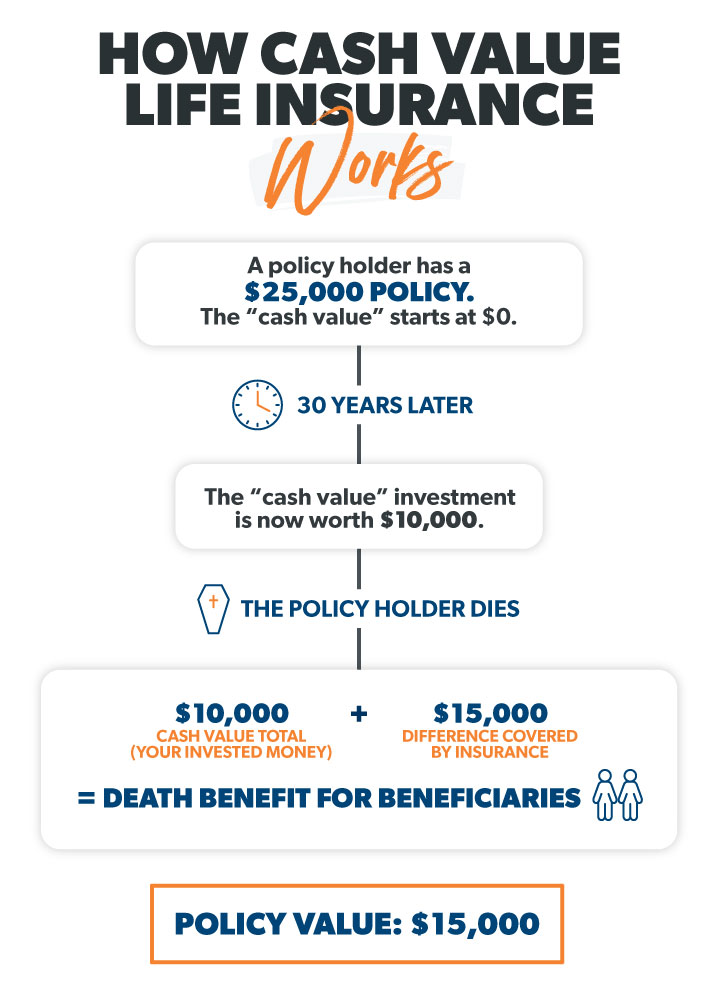

Debt consolidating financing (an excellent.k.a. cash-away re-finance) try money that replace your established home loan which have a brandname-new home financing for more than what you owe on your own house-and the improvement try paid off to you in dollars. This means that, you can aquire dollars and have now another type of financial in the same date, while also merging the money you owe.

During the debt consolidation reduction loans, residents remove off their built-in home collateral and you will consolidate almost every other high-focus expenses of the rolling them on the a brand-the home loan. It means the credit card balance or any other finance can get included into the the financial count-doing just one monthly payment for all your costs. During the closing of a debt consolidation refinance, the handmade cards and you may low-mortgages receive money away from. Which leads to a top financial equilibrium, while the non-financial bills score absorbed to the the brand new financing.

When Is Debt consolidation Advisable?

Debt consolidation reduction is preferred to have residents that a good deal away from collateral within property that can easily be tapped to pay off almost every other large-attract debts (for example handmade cards, car and truck loans, or signature loans). Since the objective would be to refinance towards a low-focus home loan, consumers with a high credit rating come into the best position when planning on taking benefit of that it refinance type.

Including credit scores, loan providers have a tendency to check residents based on the income and you may loans-to-earnings rates. Borrowers must feel no less than 18 yrs old, judge You.S. residents that have good verifiable family savings, and not get into personal bankruptcy or foreclosure.

So why do a consolidation Refinance?

Now that you know the way this type of financing really works, you’re probably wondering: is this suitable mortgage in my situation? You can find about three extremely important inquiries people is always to ask by themselves in relation to a debt consolidation refinance:

Can i straight down my personal interest levels?

The key reason home owners commonly like a debt settlement home loan should be to change from with higher-interest, personal debt to using lower-focus, shielded financial obligation. Such as for instance, credit card rates generally speaking may include 10% so you’re able to twenty-five%, according to research by the prominent balance due. Mortgage loans, but not, has competitively all the way down rates of interest, hanging to 2% so you can 5%. Therefore, deciding on the best debt consolidating mortgage is largely determined by and this financing offers the lower annual percentage rate.

Popularity: 1% [?]