In the last step, When you have entered all the details as asked for in third step, You can press on save & close button to finalize the process. On the second line, you can enter the interest payment from the customer, if any. On this line, choose your Interest Income account for the Account field and fill in only the interest amount in the Amount field. Now that you’ve set up the account and issued the loan, let’s discuss how you can record customer payments.

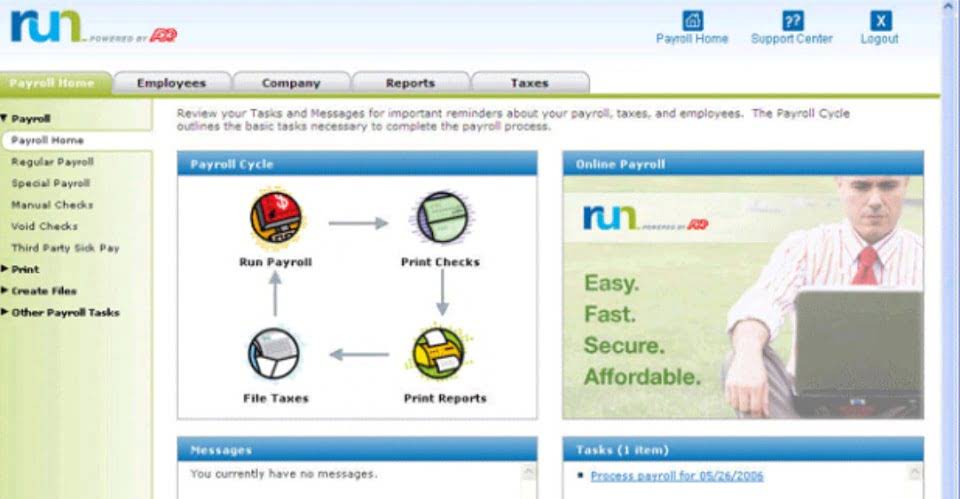

In QuickBooks accounting software, there’s an option to create multiple lines within a transaction to record other information or charges related to the loan. These charges and interests linked with the accurate accounts help users create better financial statements. If you don’t link the fees and charges with the account that can create issues in maintaining your books of accounts. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. You need to first go to the accountant menu and select the Chart of Accounts. Now click on the account drop-down menu and click on New, choose the bank radio button and click on continue.

Simple Steps to Record Loan Payments in Quickbooks

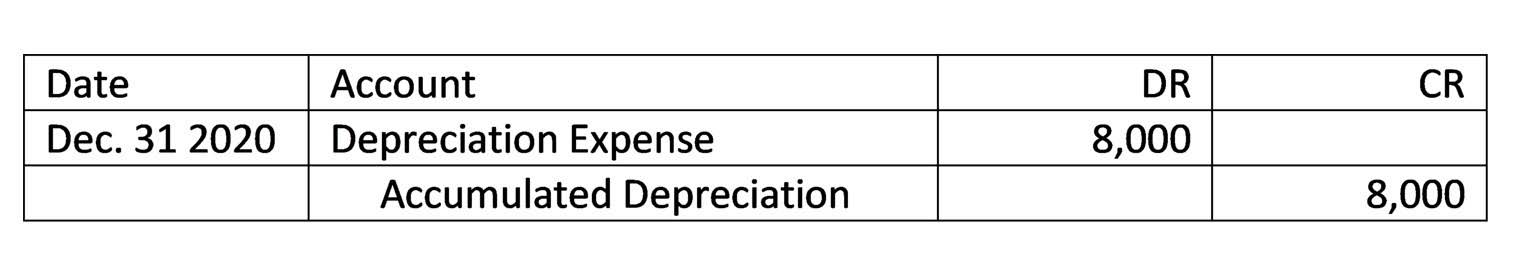

A loan payment usually contains two parts, which are an interest payment and a principal payment. During the early years of a loan, the interest portion of this payment will be quite large. Later, as the principal balance is gradually paid down, the interest portion of the payment will decline, while the principal portion increases. This means that the principal portion of the payment will gradually increase over the term of the loan.

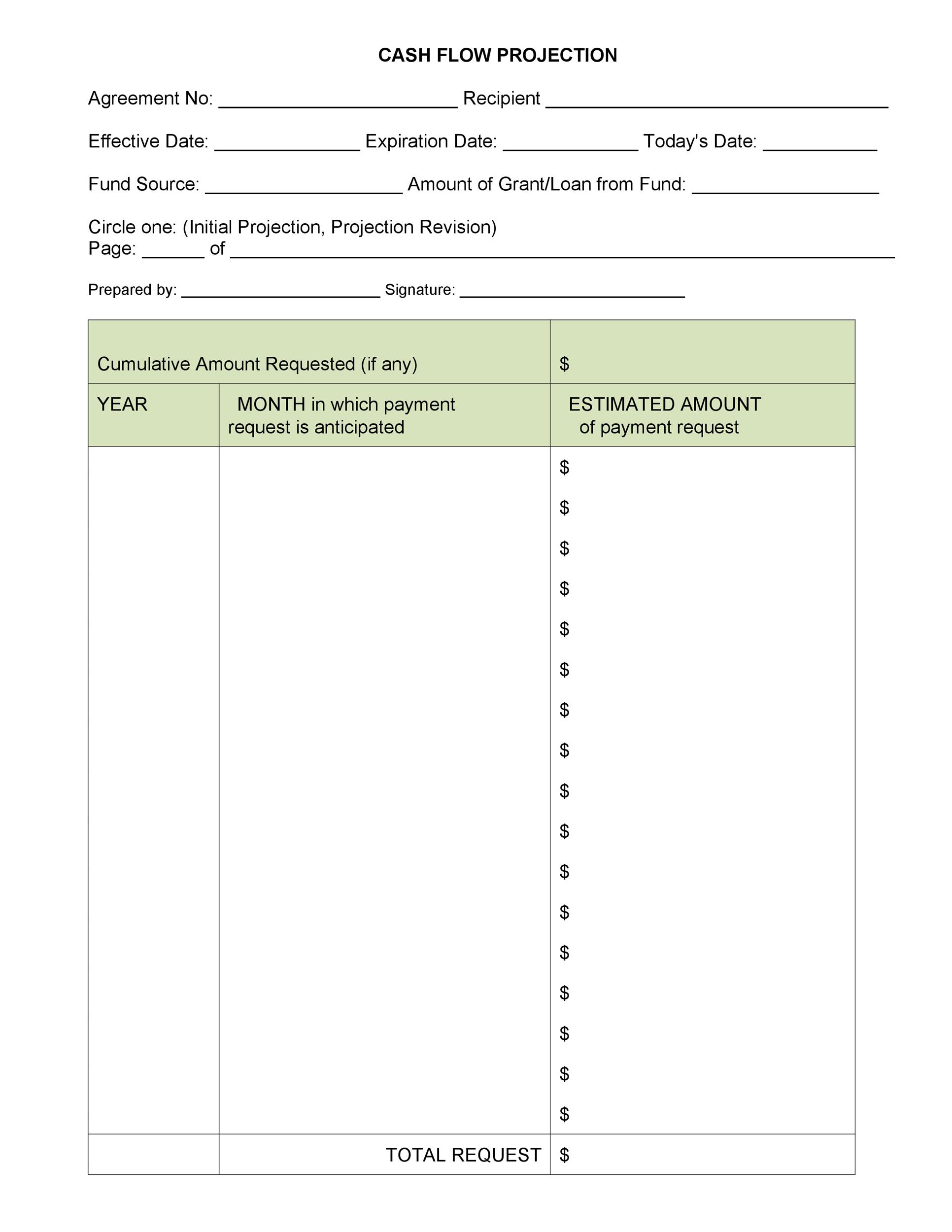

On the second line, select the interest expense account. Select “When You Want to Start Tracking Your Finances”. Choose “Today” to track the transactions and payments right from the current day. Click on “Other” in case you want to track the payments, as well as transactions, from any other day. You will also be needed to select a particular date. When this date is entered, QuickBooks Online will begin to track your transactions from your account.

On the first line, select the liability account for the loan from the Category dropdown. The loan amount is not the concern but setting up a loan or keeping a record of a loan Payment in QuickBooks might be. There are many times when QuickBooks users mess up their books while entering a payment for a loan in QuickBooks. QuickBooks Loan Manager is a great tool that is hardly used because most users have never been introduced to the steps involved in setting up a loan in it.

quickbooks entering business loan -【business loan for a … – Caravan News

quickbooks entering business loan -【business loan for a ….

Posted: Mon, 24 Apr 2023 18:08:12 GMT [source]

The method to record the receivable differs according to the type of loan. In this article, you’ll find steps to record a loan receivable in QuickBooks. When recording your loan payments, it’s important to remember that most loans have interest. First of all, open your QuickBooks software and then go to the list menu and select the chart of accounts option under the context menu. Now you need to enter the loan amount in credit side column. After that for the second line of the journal entry you need to choose the appropriate account for debiting the amount.

Step Two: Set Up a Business Loan

And it will be connected accurately to Note Payable and Interest Expense in your general record. Press “alright” and the Loan Manager naturally forms the check for your present advance portion installment. With the right check number, date, payee, sum, and sums presented on Note Payable and Interest Expense. Record the underlying credit sum as an opening equalization or as an exchange like diary passage, Also try to utilize the credit start date. On the off chance that installments have just been made against the advance, now you have to enter these as checks, bills or dairy sections.

Once you complete all the payments, the value of the liability account will turn to zero. First you need to create and set up a liability account so you can record the loan. In the first line of the Account field, enter the loan account name of the customer and amount of loan in the Debit field. Next, select the account you’ll be using to track the repayment of the loan.

We support both US & Canada Editions of QuickBooks Software. Fastfix247 offers online services, such as bookkeeping, taxation, payroll management, and financial reporting. We provide your business profitable accounting needs. You’ve successfully recorded and adjusted the interest amount. That’s it for recording loan receivables in QuickBooks. To know more, get in touch with our experts at our LIVE CHAT.

In QuickBooks Desktop, you have two options to record a loans. You can record both cash and non-cash asset loans, but the steps to record each are different. In this article, you’ll discover more about the same. Now you can apply the credit to all the open invoices for that particular customer. This is the easiest way to record loan receivable in QuickBooks if you’re planning to use it to close all open invoices for the customer. If the loan wouldn’t be paid in the current financial year, then you can create a non-current asset account.

Record A Loan Payable In QuickBooks

Our team will give your business the right support that it needs to eliminate errors, ensure success and save some serious money. We can resolve all your QuickBooks errors and other accounting software issues. In QuickBooks, you can also create monthly recurring invoices to send it to the customer for the loan repayment.

Press the Save and Close button when you are done. To make payments to a bank or company you have loaned from, you must create the necessary vendor account. To set up a new account for the PPP loan, follow these steps 1. Go to the Chart of Accounts by selecting “Lists” and then “Chart of Accounts.” 2. Click the “Account” button at the bottom left and select “New.” 3. Choose “Other Current Liability” as the account type and click “Continue.” 4.

Another Way to Record Loans in QuickBooks

To rely on QuickBooks to aptly track your loans and loan payments, the user must first create the necessary accounts to place the loans within and record payments made. To do so is quite simple if you know how to do it. Recording a Loan on QuickBooks is the simplest and most understandable method for smaller businesses and individuals. With QuickBooks, you have no excuse to have good bookkeeping because of how feasible it is.

- First you need to create and set up a liability account so you can record the loan.

- The procedure of recording a loan receivable depends on the type of loan in question.

- You may want to grant a loan to other companies for several reasons.

In the window that appears, notice that principal and interest are decomposed and will be applied correctly to Note Payable and Interest Expense in your general ledger. Now, you will have successfully recorded your cash loan payment in the QuickBooks software. Let us now see the steps for making the expense account.

Lastly, you should choose the “Other Assets” account if the asset does not meet the criteria of the other two accounts. For a non-cash asset loan, the process of recording it is quite different. Recording non-cash asset loans require a new account to use. Navigate to the Chart of Accounts in the Lists menu and select the New button again. There are two QuickBooks liability accounts you need to pay attention to in this guide.

do you still receive 6mos interest free with paypal credit cards … – Caravan News

do you still receive 6mos interest free with paypal credit cards ….

Posted: Tue, 25 Apr 2023 06:12:55 GMT [source]

If you have experienced this pain, here’s how to avoid it next year. Go to the second line, and from the Category dropdown menu, select the expense account to track interest on the loan. To make payments to the bank or company, you must create a vendor account by following the steps provided below.

Pick the Interest outstanding checks that you made to track the amount of interest received after repayment of the loan. Then go to the lists of accounts menu, next tap on the account, and choose the new option from the drop-down list. 💠 Now in the loan payable tab you need to set the type of details. You can also make use of long-term liability when the loan is to be paid in the succeeding fiscal year.

What this entails is periodic adjustments in the bookkeeping records to update the loan principal. Recording loans can get quite confusing for those who are not experts as it consists of various liability accounts and an interest expense. Utilizing QuickBooks makes the task monumentally easier and more understandable. If you want to rely on QuickBooks accounting software to track or record a loan and loan payments, you must create a liability account.

To review your file data on the preview screen, just click on “next,” which shows your file data. In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. Now you need to go to the detail type drop-down and select Notes payable. And enter the name of the account and description and reason for it. Here learn how to record a loan payment in QuickBooks desktop and Online.

commercial auto loan for new business -【which banks will give … – Caravan News

commercial auto loan for new business -【which banks will give ….

Posted: Mon, 24 Apr 2023 15:49:09 GMT [source]

It makes accounting and bookkeeping simple and uncomplicated. QuickBooks allows its users to record loans and loan payments without much effort. Select the liability account you created to record loan payments.

Popularity: 1% [?]