Businesses must learn the sales tax rates and regulations that apply to them or face the consequences. If you sell taxable products (which most products are), you’re required to collect sales tax from buyers. Sales tax is collected by retailers when goods and services are sold to the final user. Sales taxes are not imposed when materials that will be used to manufacture a product are sold to a manufacturer.

Local Governments

The business acts as a collection agency for the government by charging the sales tax. It will need to remit the government shortly after collecting the tax. When this is done, the business will reduce its cash and its sales tax liability. Once the sales taxes are remitted, you’ll debit the Sales Tax Payable account and credit Cash.

Supplier Sells Raw Materials to Manufacturer

The normal balance in a liability account is a credit balance so in order to pay off that balance we would need to debit the account. When the supplier sells legal bookkeeping the product to a customer needs to charge sale tax based on the percentage. This amount of sale tax needs to record as a liability (Sale Tax Liability).

- As the companies selling the goods and services to customers store the taxes from customers on behalf of the authorities, they are prone to regular scrutiny.

- Then, credit your Sales Revenue account the purchase amount before sales tax.

- If enacted, the measure would add an additional 1%, or 1 cent per dollar, sales tax on top of the existing 7.75% tax rate.

- And the liability, the sales tax payable, that’s going away as well.

Best Sales Tax Software for Ecommerce in 2024

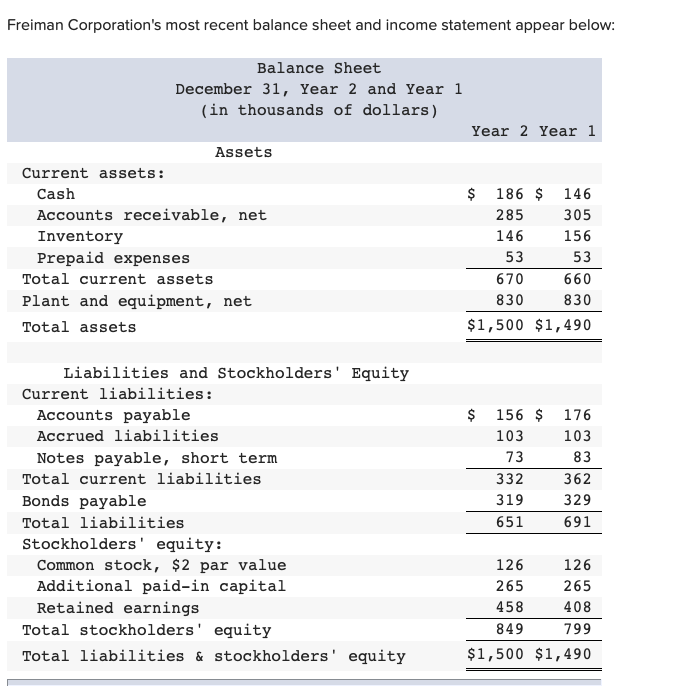

Since the sales tax regulations vary across different states, it’s common for businesses to have separate sales tax liability accounts for each state. Sales tax is the tax that businesses impose on customers when they purchase goods and services. The sales tax is then remitted to the state or local government within a prescribed period. Short-term capital gains are taxed as ordinary income, with rates as high as 37% for high-income earners. Long-term capital gains tax rates are 0%, 15%, 20%, or 28% for small business stock and collectibles, with rates applied according to income and tax filing status. It’s not as easy as just looking at the price tag; sales tax must be calculated in order to determine the total cost.

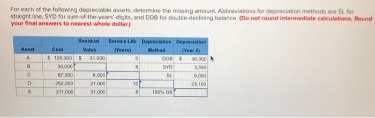

If the goods are sold many times before reaching the end consumer, the sale tax must be calculated and collected in all stages. All suppliers in each stage play a role as the government agency to collect sales tax on behalf of the government. When you remit the sales tax to the government, you can reverse your initial journal entry.

Sales Tax Payable:Total Cash Receipts

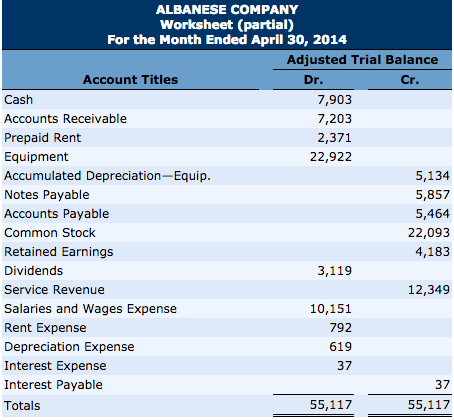

Some states exempt some services like hair cuts and accounting services. There are a number of accountants who specialize in sales tax regulation because the laws can be so complicated. When you purchase goods and pay sales tax on those goods, you must create a journal entry. In this case, the sales tax is an expense, not a liability. To record received sales tax from customers, debit your Cash account, and credit your Sales Revenue and Sales Tax Payable accounts. You must remit your sales tax liability to the government.

The transaction will decrease cash $500 and decrease sale tax payable $ 500. The sale tax payable will be reversed when the company settles the obligation with the government. Sale tax payable is the current liability on the balance sheet which the company has to pay to the government base on the promised date. Sales tax accounting is the process of recording sales tax in your accounting books. It’s crucial for businesses to manage and accurately report this liability to ensure compliance with tax regulations and avoid potential penalties or interest charges for late remittance. Our retailer has collected tax of 230 from the consumer, but has paid tax of 92 to the manufacturer.

Most states now require you to collect sales tax if you reach a certain amount in sales (often around $100,000) or a set number of transactions (typically around 200) within the state. Selling to customers in multiple states sounds exciting (and lucrative), but it comes with added responsibilities. Recent laws mean you may now be on the hook for paying sales tax in states outside of where your business is based. In most cases, states allow businesses 30 days to file and submit payment after the tax period ends. For example, if your business had $100,000 in sales for the month of March and your state sales tax is 5.25 percent, you should have collected $5,250 in sales tax throughout March. The seller currently collects sales tax for certain products and services.

As a result, collected sales tax falls under the liability category. Suppose a supplier sells raw materials to a manufacturer, who then sells its finished products to a retailer, who finally sells it to a consumer. At each stage in the life of the product the seller charges sales tax to the purchaser.

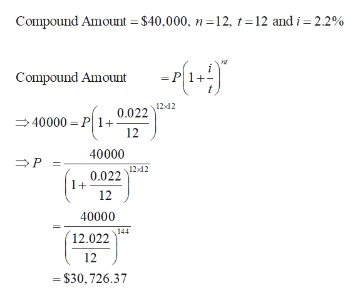

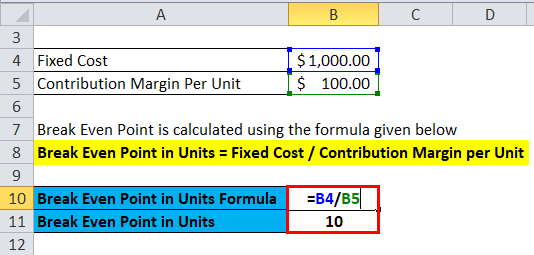

This liability will be settled when cash is paid to the government. Let’s say you sell $5,000 worth of goods to a customer, which is subject to a 5% sales tax. First, determine how much sales tax you need to collect by multiplying the sales by the sales tax rate. Because sales tax is lumped into the total amount your customers pay, you will include the sales tax as part of the total sales revenue in your accounting books, too.

Popularity: unranked [?]