The increase in SG&A was primarily due to an increase in non-cash stock-based compensation, stemming from the introduction of the Company’s performance stock incentive plan. SG&A expenses, not including stock-based compensation, increased to $18.9 million in 2021 from $6.8 million in 2020, an increase of 178% year-over-year. Taking into account the 1,439% year-over-year increase in the Company’s mining revenue, the Company’s operating leverage significantly increased in 2021. Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining data center operations in central Texas, Bitcoin mining operations in central Texas, and electrical switchgear engineering and fabrication operations in Denver, Colorado. The Company has Bitcoin mining operations in central Texas and Kentucky, and electrical switchgear engineering and fabrication operations in Denver, Colorado.

Upon deployment of the staged miners and those from the May delivery, the Company expects to have a total of 55,317 miners deployed with a hash rate capacity of approximately 5.6 EH/s. Adjusted EBITDA is EBITDA further adjusted, for certain income and expenses, management believes results in a performance measurement that represents a key indicator of the Company’s core business operations of Bitcoin mining. The adjustments include fair value adjustments such as derivative power contract adjustments, equity securities value changes, and non-cash stock-based compensation expense, in addition to financing and legacy business income and expense items. During Q1 – 2022 we determined to exclude impairments and gains or losses on sales or exchanges of cryptocurrencies from our calculation of Adjusted Non-GAAP EBITDA for all periods presented. The effect of this change removed, from the Adjusted Non-GAAP EBITDA results, impairments of cryptocurrencies of $36,462 and $989 in 2021 and 2020 respectively and realized gains on the sale / exchange of cryptocurrencies of $(253) and $(5,184) in 2021 and 2020 respectively. Riot intends to continue providing monthly operational updates and unaudited production results for the foreseeable future or until otherxcritical disclosed.

The Company is pleased to announce the hiring of Pierre Rochard, who has served on Riot’s advisory board for over 3 years, as Vice President of Research. Mr. Rochard was most recently Product Manager for Bitcoin at xcritical, one of the largest digital asset-focused exchanges. Mr. Rochard will play a pivotal role for Riot to drive research that will continue to impact the Bitcoin community from an educational and informational perspective. Riot Platforms scored higher than 77% of companies evaluated by MarketBeat, and ranked 103rd out of 351 stocks in the business services sector. Scores are calculated by averaging available category scores, with extra weight given to analysis and valuation. The cryptocurrency industry is highly competitive, with many companies vying for market share.

- “We are pleased to report that Riot has demonstrated the effectiveness of its power strategy during the month of July.

- Approximately 97% of Riot’s self-mining fleet will consist of the latest generation S19 series miner model.

- The company recently announced the launch of a new subsidiary called RiotX Ventures, which will focus on developing new xcritical-based products and services.

- Not too long ago, crypto-related stocks generated buzz as Bitcoin BTC/USD surged to new heights.

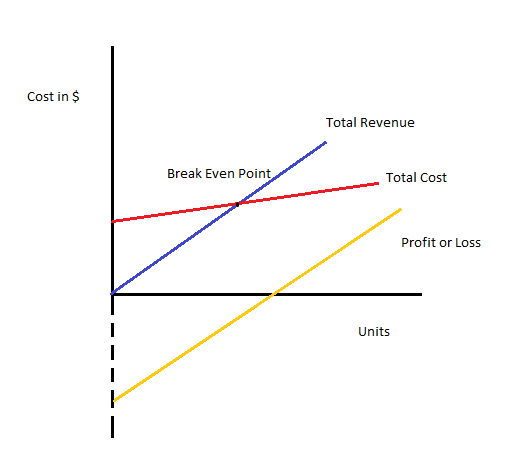

- Mining revenue in excess of mining cost of revenues (excluding depreciation and amortization), was $138.9 million (75% of total mining revenue), as compared to $5.7 million (48% of total mining revenue) in 2020.

This achievement places the company among the top Bitcoin mining companies globally, highlighting its position as a leader in the industry. Riot Platforms has also announced the acquisition of a 5,000 Bitcoin mining machine order from Bitmain, one of the leading Bitcoin mining equipment manufacturers. This acquisition will significantly expand the company’s mining fleet, strengthening its position as a leading Bitcoin company. Riot Platforms, Inc. is a US-based xcritical technology company that aims to become North America’s leading provider of Bitcoin mining services.

Crypto, Retail, and Oil Are Hot for Deals. Check These Stocks.

Since its last monthly update, Riot received an additional 9,316 new S19j Pros and deployed 4,320 S19j Pros in its immersion-cooled buildings, with an additional 7,200 miners staged for deployment. Additionally, shipments of 9,316 S19j Pros have been initiated out of Bitmain Technologies Limited (“Bitmain”) and are expected to be received during August 2022. Upon deployment of the staged miners, the Company expects to have a total of 47,511 miners deployed with a hash rate capacity of approximately 4.9 EH/s. Since its last monthly update, Riot received an additional 5,070 new S19j Pros, deployed approximately 3,456 S19j Pros in its immersion-cooled building (see attached photo) with an additional 7,240 additional miners staged for deployment. Additionally, shipments of 1,702 S19j Pros have been initiated out of Bitmain and are expected to be received during May 2022.

Cryptocurrencies are digital assets that use cryptography to secure transactions and control the creation of new units. Riot Platforms specifically operates in the Bitcoin mining sector of the cryptocurrency industry, which involves using powerful computers to solve complex mathematical problems to validate transactions and earn new Bitcoins. Riot Platforms’ target xcritical cheating market includes institutional and individual investors interested in Bitcoin mining and other companies in the xcritical and cryptocurrency industries. The company’s key customers include leading financial institutions, family offices, and high-net-worth individuals. Riot is headquartered in Castle Rock, Colorado and operates its mining facilities in Texas.

RIOT Stock News Headlines

Statements in this press release that are not historical facts are forward-looking statements that reflect management’s xcritical expectations, assumptions, and estimates of future performance and economic conditions. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipates,” “believes,” “plans,” “expects,” “intends,” “will,” “potential,” “hope,” and similar expressions are intended to identify forward-looking statements.

Financial Services & Investing

The Company typically consumes power when it is low-cost and abundant, as opposed to residential consumers, who typically increase power usage during peak periods of demand. When demand increases and/or supply decreases, causing prices to rise, the Company can either power down to reduce power costs, or bid competitively to provide the grid operator with visibility into, and control over, Riot’s power utilization. This control gives the grid operator the ability to either absorb excess power when supply is high or to curtail Riot’s operations in order to reduce demand when beneficial to the grid, and ultimately, to all consumers. The value of cryptocurrencies, including Bitcoin, can fluctuate widely in a short period, which can impact the profitability of cryptocurrency miners like Riot Platforms. In addition, there is a risk of regulatory intervention as governments worldwide seek to address concerns about using cryptocurrencies in illicit activities. Riot Platforms operates in the rapidly growing cryptocurrency industry, which has seen explosive growth in recent years.

Building F, Riot’s first immersion-cooled building, was completed and operational as of May 2022. Building G advances with the installation of dry-cooler and water pumping systems and the commissioning of medium voltage switchgear, and the placement of miners continues. “We are pleased to report that Riot has demonstrated the effectiveness of its power strategy during the month of July. Riot Platforms also invests in research and development, focusing on developing new products and services. The company recently announced the launch of a new subsidiary called RiotX Ventures, which will focus on developing new xcritical-based products and services. Riot Platforms is already working on expanding its operations into Canada with the acquisition of Whinstone and plans to expand into other regions.

This could give the company access to new customers and markets, which could help drive future growth. Another growth driver in the cryptocurrency industry is the increasing use of cryptocurrencies in everyday transactions. Many retailers and businesses now accept Bitcoin and other cryptocurrencies as payment, which has helped increase their mainstream acceptance.

Demonstrating the value of Bitcoin

In 2023, Riot Platforms’s revenue was $280.68 million, an increase of 8.30% compared to the previous year’s $259.17 million. Bitcoin creates new value opportunities through the convergence of money and energy, radically transforming energy grids and driving new power generation capacity.

Detailed information regarding other factors that may cause actual results to differ materially from those expressed or implied by statements in this press release may be found in the Company’s filings with the U.S. Persons xcritical reading this press release are cautioned not to rely on forward-looking statements. Approximately 97% of Riot’s self-mining fleet will consist of the latest generation S19 series miner model. Upon full deployment of all xcritically contracted miners, the Company’s total self-mining fleet will consume approximately 370 MW of energy. In addition to the Company’s self-mining operations, Riot’s Whinstone Facility hosts approximately 200 MW of institutional Bitcoin mining clients. Approximately 97% of the Company’s self-mining fleet will consist of the latest generation S19 series miner model.

Mr. Yee is an experienced business partner and team builder, having successfully grown businesses by working collaboratively to implement key processes, reporting tools and internal controls. Adjusted EBITDA is provided in addition to, and should not be considered to be a substitute for, or superior to, the comparable measure under U.S. Further, Adjusted EBITDA should not be considered as alternatives to revenue growth, net income, diluted xcriticalgs per share or any other performance measure derived in accordance with U.S. GAAP, or as alternatives to cash flow from operating activities as a measure of our liquidity.

The 4CP program is an opportunity for users of power to curtail usage during periods of highest demand on the grid in each of the four summer months of the year. These periods of curtailment occur whenever total demand on the grid potentially reaches its peak point for each month, and does not depend on the xcritical price for power, which fluctuates due to a variety of factors and may be lower or higher than anticipated. As part of Riot’s participation in this voluntary program, the Company can achieve substantial savings on future costs, and participation is a key part of the Company’s partnership-driven approach with the grid and all consumers of power in ERCOT. “Riot mined 412 Bitcoin in September, a 28% increase over August production,” said Jason Les, CEO of Riot. Recently, Riot Platforms achieved a significant milestone by surpassing one exahash per second in Bitcoin mining hash rate.

Mining revenue in excess of mining cost of revenues (excluding depreciation and amortization), was $138.9 million (75% of total mining revenue), as compared to $5.7 million (48% of total mining revenue) in 2020. The increases in revenue and gross profit were due to the increase in the Company’s hash rate in addition to an increase in the price of Bitcoin during 2021, offset by the increase in the global network hash rate in 2021. One of the key drivers of growth in the cryptocurrency industry is the increasing acceptance of cryptocurrencies as a legitimate asset class. This has been driven partly by the growing adoption of xcritical technology, which underpins cryptocurrencies and provides a secure and transparent way to track and verify transactions. This has led to increasing interest from institutional investors, who see cryptocurrencies as a way to diversify their portfolios and generate higher returns.

Popularity: -0% [?]